Top 10 Common Tax Mistakes and How to Avoid Them

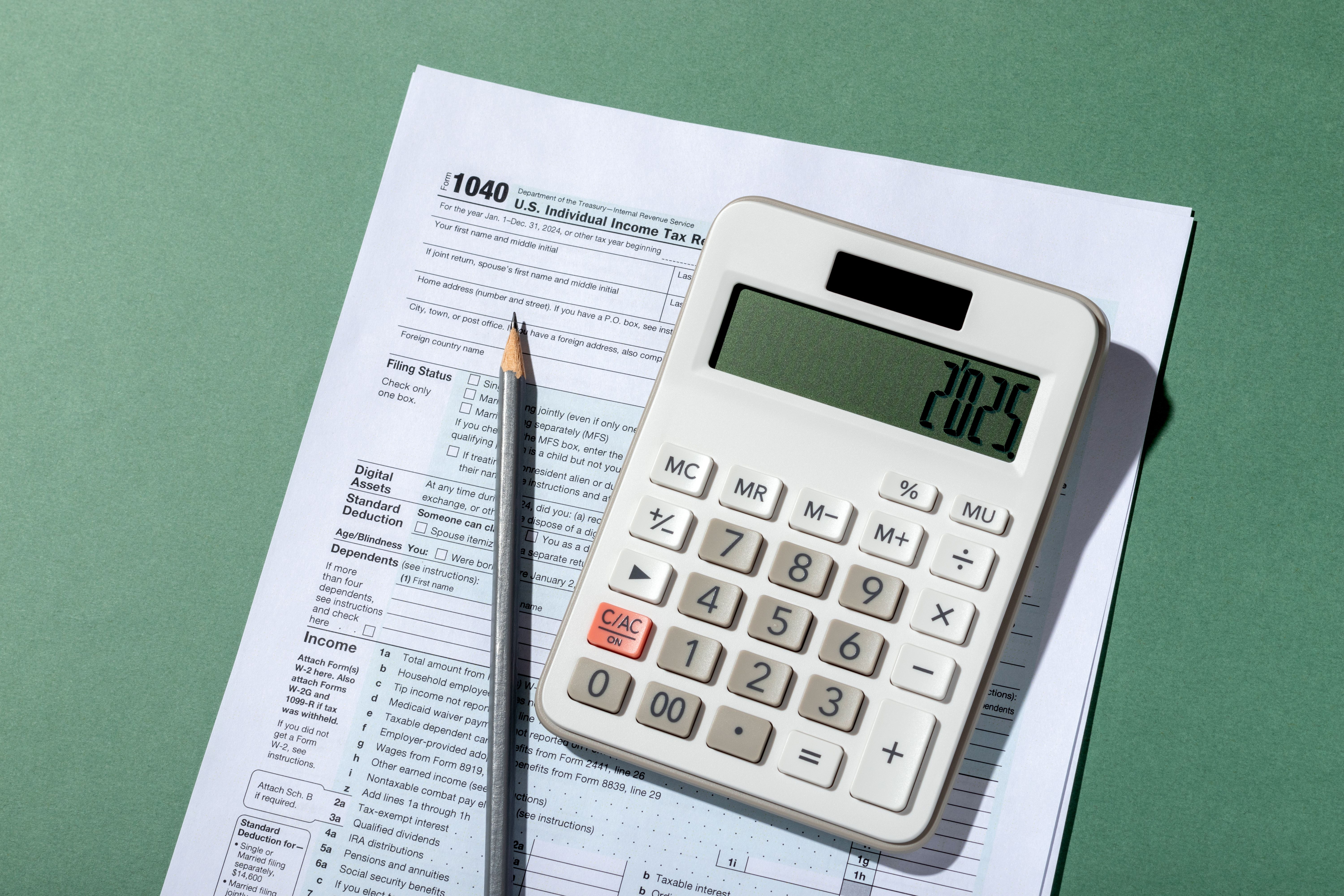

Introduction

Filing taxes can be a daunting task, and even the most meticulous individuals can make mistakes. These errors can lead to penalties, delayed refunds, or audits. Understanding common tax mistakes and how to avoid them is crucial for ensuring a smooth tax season.

1. Filing Late

One of the most common mistakes is filing your tax return late. The IRS imposes penalties for late filing, which can add up quickly. To avoid this, mark your calendar with important tax deadlines and consider filing electronically for faster processing.

Procrastination

Many taxpayers delay filing, hoping to gather all necessary documents later. However, this can lead to unnecessary stress and errors. Start early to ensure you have plenty of time to gather documents and seek help if needed.

2. Incorrect or Missing Information

Errors such as incorrect Social Security numbers, names, or bank account details can delay your refund. Double-check all personal information before submitting your return.

Missing Income

Forgetting to report income from freelance work or side gigs is another common mistake. Ensure you have all your W-2s and 1099s before filing to avoid discrepancies.

3. Math Errors

Simple math errors can result in significant issues with your tax return. While software can help minimize these mistakes, it's important to review calculations for accuracy.

Using Tax Software

Consider using reliable tax software that automatically checks for errors and provides guidance. This can help reduce the likelihood of mistakes due to manual calculations.

4. Ignoring Tax Deductions and Credits

Overlooking available deductions and credits can lead to paying more taxes than necessary. Familiarize yourself with deductions and credits relevant to your situation.

Common Deductions

Some common deductions include student loan interest, mortgage interest, and charitable donations. Ensure you have documentation to support any deductions claimed.

5. Not Keeping Proper Records

Failing to keep organized records can make tax filing more complicated and increase the risk of errors. Maintain a systematic filing system for all tax-related documents.

Document Retention

Keep copies of past tax returns and supporting documents for at least three years. This can be crucial if you need to amend a return or if questioned by the IRS.

Conclusion

Avoiding these common tax mistakes can save you time, money, and stress. By staying organized, filing early, and double-checking your work, you can ensure a smoother tax season. If in doubt, consult a tax professional for guidance.